Here’s the promised personal walk-through of NVIDIA’s Q2 FY2026 10-Q, We’ll follow the same playbook from my post " How to Read a 10-Q": Income Statement → Balance Sheet → Cash Flow → MD&A → Risk Factors → Compare to Expectations→ Call Commentary. Think of this as me sitting down with you, flipping through the filing, and pointing out what really matters.

Table of Contents

1. Income Statement — “Show Me the Money”

Revenue: $46.7B (+56% YoY). Slightly above Wall Street’s ~$46.2B consensus.

Gross Margin: 72.4% (down from 75.1% YoY, but a big rebound from Q1’s hit due to H20 inventory charges).

Operating Income: $28.4B (+53% YoY).

Net Income: $26.4B, EPS $1.08 (+59% YoY, beat EPS consensus $1.01–1.02).

Drivers: Data Center = $41.1B (88% of total), fueled by Blackwell GPUs & networking (NVLink, InfiniBand).

2. Balance Sheet — “Strength or Stress?”

Cash & Securities: $56.8B (up from $43.2B in Jan 2025).

Debt: $8.5B (flat, very manageable).

Inventories: $15.0B (+48% vs Jan 2025) — a yellow flag. Blackwell ramp and H20 write-offs are swelling this line.

Equity: $100.1B (up from $79.3B), even after $24.2B of buybacks in six months.

💡 My read: NVIDIA is a fortress financially. Tons of liquidity, little leverage. Whether inventory clears smoothly deserves attention.

3. Cash Flow — “Follow the Cash”

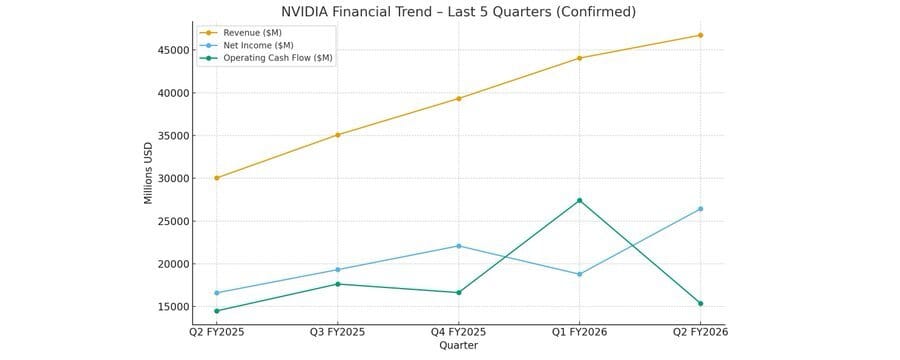

Here’s where it gets interesting. The chart below tells the story better than words:

NVIDIA Financial Trend – Last 5 Quarters

Q1 FY26 OCF: $27.4B, a record spike.

Q2 FY26 OCF: $15.4B, down sharply despite higher net income.

Reason: Working capital swings — big jumps in receivables/inventories can sap near-term cash.

📌 Translation: Net income looks smooth, but cash is bumpier. Always check this.

4. MD&A — “Management’s Voice”

What NVIDIA said between the lines:

AI Demand = Strong. Blackwell Ultra GPUs are ramping fast, hyperscalers (cloud giants) account for ~50% of Data Center revenue.

China Risk = Real. H20 GPU sales to China blocked; Q2 saw $650M H20 sales only outside China.

Networking = Explosive. $7.3B (+98% YoY), showing demand for complete AI systems (not just chips).

Tone: Optimistic on AI, but cautious on regulation, energy shortages, and open-source AI adoption that could shift developer loyalty.

5. Risk Factors — “Read the Fine Print”

Export Controls: Biggest risk. U.S. may demand up to 15% revenue cut on licensed H20 exports. Still unresolved.

China: Possible retaliation; regulators questioning NVIDIA’s commitments from the Mellanox deal.

Open-Source AI: If developers favor non-NVIDIA platforms, ecosystem moat weakens.

Legal: Ongoing derivative suits tied to older crypto disclosure issues.

6. Compare to Expectations

Beat on Both Revenue & EPS.

Guidance: Q3 revenue $54B ±2% (no China H20). That’s above Wall Street’s $52.7B expectation.

Market Reaction: Stock slipped anyway — why? Investors are spooked by uncertainty in China.

7. Earnings Call Commentary — “What They Said Out Loud”

Colette Kress (CFO):

Blackwell revenue grew 17% sequentially; smooth ramp to GB300 racks.

Rubin platform already taped out, volume next year.

$2–5B potential H20 shipments in Q3 if licenses clear (not assumed in guide).

Networking annualized revenue >$10B, fastest-growing adjacencies.

Returned $10B to shareholders; $60B new buyback approved.

Jensen Huang (CEO):

Agentic AI = new wave: models that reason, plan, and use tools. Compute needs = 100–1,000x larger than old chatbots.

Vision: AI infra buildout = $3–4T by decade’s end. NVIDIA is positioned as the AI infrastructure company, not just a GPU vendor.

On ASICs: “We’re chosen because we’re everywhere, with the full stack.” Customers value long-term utility vs. narrow ASIC solutions.

Networking: NVLink72, InfiniBand, Spectrum XGS = pillars of scale-up, scale-out, and scale-across superfactories.

China: Sees ~$50B opportunity; half of AI researchers & leading open-source models are in China. Advocating for access.

Rubin & Beyond: Annual cadence to improve perf/watt, maximize customer ROI. “Each year should be record-breaking.”

Long-term: Sees 50% CAGR for AI infra market; demand “everything sold out.”

🎯 My Take

NVIDIA is running on two tracks:

The numbers (10-Q): $47B revenue, $26B profit, cash-rich.

The narrative (earnings call): AI infra as the next industrial revolution, with NVIDIA as the “standard stack” for every hyperscaler and startup.

The risks are clear — geopolitics (China), inventory, and potential ASIC competitors. But the moat is just as clear: full-stack + ecosystem lock-in.

Buffett’s reminder: read not just what they print, but what they don’t. They didn’t print “all clear” on China, nor assurance that cash flow will scale as smoothly as EPS.