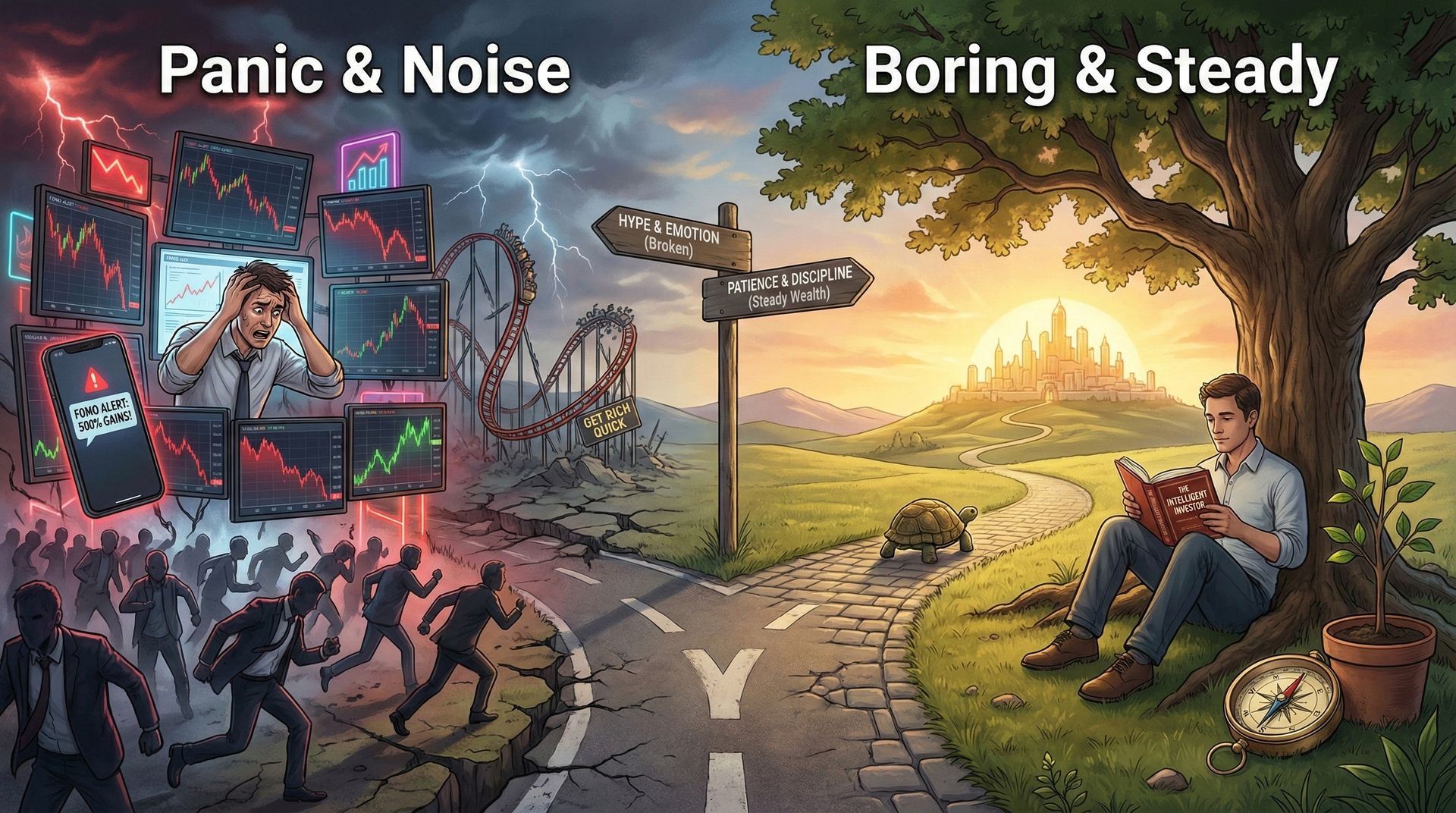

Does it feel like everyone is getting rich overnight except you?

You open your phone and see screenshots of 500% gains on the latest AI startup or crypto coin. It triggers a very specific anxiety: FOMO (Fear Of Missing Out). You start wondering if your steady, boring portfolio is a mistake.

But here is the truth the "get rich quick" crowd won't tell you: Excitement is the enemy of wealth.

Decades ago, Benjamin Graham, the mentor of Warren Buffett, laid out a blueprint for investing that thrives on patience, not adrenaline. While the market context changes, from the dot-com bubble of 1999 to the AI hype of today, human psychology remains exactly the same.

Here are the 8 rules that have stood the test of time, modernized for the Relax to Rich investor.

1. Don’t Trust the Market’s Mood Swings

The market is manic-depressive. One day it’s euphoric, the next it’s despondent. Graham famously said the market is a "voting machine" in the short term (driven by popularity) but a "weighing machine" in the long term (driven by substance). Never confuse a stock’s price with its business value.

2. Check Your Ego (It’s Hard to Beat the Market)

We all like to think we are smarter than average. But the data shows that most active stock pickers fail to beat simple, broad index funds over time. There is no shame in being "average" when the market average historically builds massive wealth.

3. Trends are Traps

Buying what has already gone up is a recipe for disaster. Momentum works until it suddenly doesn't. Whether it was airline stocks in the 20s or tech stocks today, paying a premium for a "hot" trend usually leads to disappointment when gravity kicks in.

4. You Cannot Time the Market ⏳

Stop waiting for the "perfect" time to buy or sell. Even the experts fail at this. If you try to dance in and out of the market, you will likely miss the best days of the year, which destroys your long-term returns.

5. Math Beats Magic

Optimism is not an investment strategy. In 1999, people bought companies with zero earnings because they believed in a "new era." Today, people do the same. Always ground your expectations in arithmetic, earnings, dividends, and assets, not in vague stories about the future.

6. Buy "Used" Stocks, Not New Ones (IPOs)

Initial Public Offerings (IPOs) are often marketed at peak hype to maximize profit for the seller, not you. Instead of chasing the shiny new thing, look for established companies ("Old Public Offerings") that have a proven track record and are trading at fair prices.

7. Look Where Others Won’t ❄️

Graham loved "cold" industries, sectors that are currently unloved or boring. While everyone is fighting over the expensive tech giants, deep value is often found in the unglamorous companies that quietly make money year after year.

8. The Golden Rule: Hang in There

This is the most critical rule. History shows that steady investment, putting a fixed amount of money to work every single month regardless of headlines, is the surest path to millions.

Whether the market is crashing or soaring, if you keep buying, you lower your average cost and capture the recovery. You don't need to be a genius; you just need to be disciplined.

The Bottom Line: Investing isn't a game show. It’s a slow, steady climb. If you can tune out the hype and stick to these principles, you won't just survive the next crash, you'll profit from it.

What is one "boring" stock you own that helps you sleep at night? Reply and let me know!