Table of Contents

1. Introduction: The Age of the Digital Supermajority

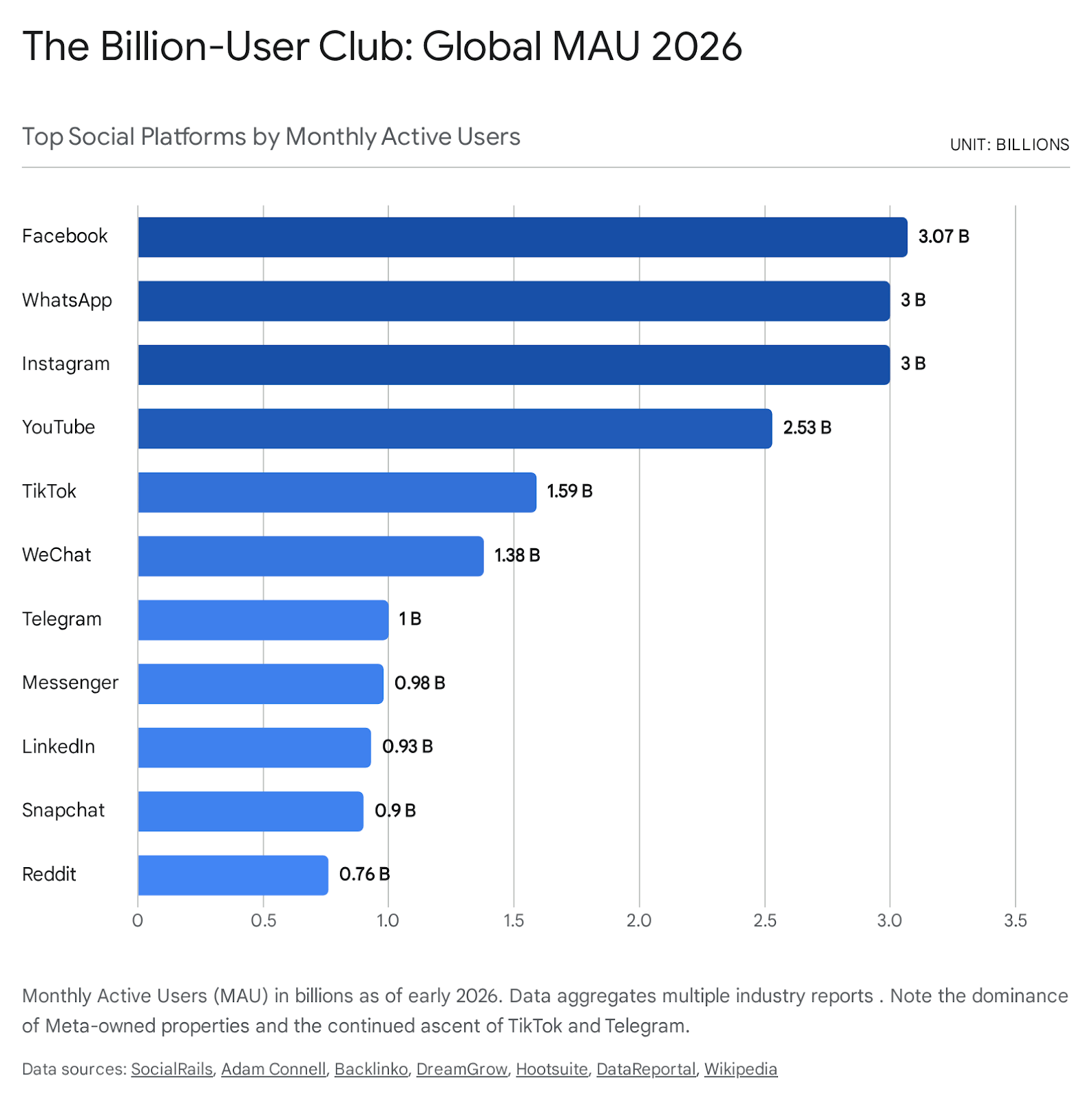

As we navigate the first quarter of 2026, the social media landscape has matured into a ubiquitous global infrastructure that rivals electricity or telecommunications in its reach and societal impact. The era of rapid adoption has largely concluded, replaced by a period of intense saturation and deepening engagement. According to detailed analyses of digital behaviors, the global population has crossed a historic threshold: there are now 5.66 billion social media "user identities" worldwide.1 This figure indicates that more than two-thirds of the human population now engages with social platforms on a monthly basis, effectively creating a "supermajority" where users outnumber non-users by a ratio of two to one.1

The velocity of this growth, while slowing compared to the explosive adoption curves of the 2010s, remains relentless. The global user base expanded by approximately 259 million distinct identities over the preceding twelve months, equating to an annualized growth rate of 4.87 percent.1 This translates to a staggering intake of roughly 7.8 new users every single second.1 However, the definition of a "user" has become increasingly complex. The discrepancy between "user identities" and unique individuals suggests that the average modern consumer manages a portfolio of digital selves. Indeed, data reveals that the typical social media user now actively maintains accounts on an average of 6.75 different platforms 1, segregating their digital lives into distinct spheres of professional networking, personal communication, passive entertainment, and niche community participation.

The pervasive nature of these platforms is further underscored by the intensity of daily usage. The average global user now dedicates 2 hours and 21 minutes per day to social media consumption.3 This metric is not merely a reflection of leisure time but indicates a fundamental shift in how humanity conducts its cognitive labor, social grooming, and economic transactions. Social media has effectively captured 68.5% of the total global population 3, a figure that rises to 93.8% when isolating the internet-connected population.1 In major economies, this penetration is nearly absolute; 96.9% of internet users aged 16 and above in 54 of the world's largest economies engage with at least one social network monthly.1

This report offers an exhaustive analysis of the competitive dynamics defining 2026. We observe a market that has bifurcated along two primary strategic axes: the utility of the platform (ranging from personal connection to algorithmic discovery) and the architecture of the ecosystem (ranging from centralized walled gardens to emerging decentralized federations). While the industry was previously defined by a race for user acquisition, the current competitive battleground is defined by "cognitive share"—the struggle to monopolize the user's intent, whether that intent is to learn, to buy, or to communicate. We are witnessing the transition of social apps into "Knowledge Engines" that challenge legacy search giants, the integration of generative artificial intelligence as a mandatory infrastructure layer, and the maturation of social commerce into a trillion-dollar economy.

2. The Meta Conglomerate: The Architecture of Identity

In 2026, Meta Platforms Inc. continues to operate as the gravitational center of the social web, maintaining an ecosystem so vast that it functions more as a digital utility than a mere collection of applications. The company’s strategy has evolved from simple connectivity to ecosystem lock-in, where the synergies between its platforms create a defensive moat that is nearly impossible for singular competitors to breach.

2.1 Facebook: The Resilient Utility Layer

Despite a decade of predictions regarding its irrelevance to younger demographics, Facebook remains the singular most dominant platform in the world, boasting 3.07 billion monthly active users (MAU).1 It is the only platform to have effectively digitized the global directory of human identity. Its competitive advantage in 2026 lies not in cultural trendsetting—a baton long since passed to TikTok—but in its unparalleled utility for community organization and local commerce.

The demographic profile of Facebook provides insight into its enduring stability. While it skews older than its competitors, it retains a massive chunk of the commercially vital 25-34 age bracket, which constitutes 31% of its user base.4 The platform leans slightly male, with 56.8% of its audience identifying as male and 43.2% as female.4 This demographic spread supports its status as the "utility layer" for the adult world.

The core pillars of Facebook's 2026 dominance are Marketplace and Groups:

Facebook Marketplace: With over 40% of Facebook users actively engaging in purchases on the platform 5, Marketplace has evolved into a localized commerce giant that rivals dedicated platforms like eBay or Craigslist. The "trust moats" inherent in Facebook—where buyers and sellers are tethered to real-name profiles with social history—provide a level of security and accountability that anonymous classifieds cannot match. It has become the default engine for the circular economy in North America and Europe.

Community Groups: The "Groups" feature remains the sticky infrastructure for local governance, health support networks, and hobbyist communities. This creates a high switching cost; users cannot easily migrate a neighborhood watch group or a localized support network to a fragmented platform like Discord or TikTok.

Engagement metrics further validate this utility thesis. The average user spends nearly 19 hours and 47 minutes per month on the Facebook app 4, and 68.5% of users access the platform daily.3 This habitual, high-frequency usage ensures that Facebook remains the primary data collection engine for Meta’s advertising algorithms, fueling the precision targeting that subsidizes the rest of the ecosystem.

2.2 Instagram: The Visual Mall and Authenticity Paradox

Instagram has successfully navigated the transition from a static photo-sharing app to a dynamic multimedia entertainment engine, boasting 2 billion MAU 6 and achieving a milestone of 3 billion MAU by some aggressive estimates in 2025.2 It stands as a critical bridge in Meta’s portfolio, capturing the youth demographic that Facebook has largely lost while retaining the commercial intent that TikTok struggles to fully capitalize on.

The platform’s competitive strategy in 2026 is defined by the tension between "performance" and "authenticity." The rise of Instagram Reels—now consumed at a rate of 138.9 million reels every minute alongside Facebook 2—was a direct defensive maneuver against TikTok. This feature has succeeded in neutralizing TikTok’s existential threat by offering a "good enough" short-form video experience within an app where users’ social graphs already reside.

However, a significant cultural shift known as "de-influencing" has reshaped the platform’s marketing dynamics. Originating in 2025, this trend saw creators gaining trust by telling audiences what not to buy, effectively weaponizing honesty against the polished, deceptive aesthetic that previously defined the platform.7 In 2026, the "trust equation" has changed; audiences now punish marketing theater and reward "radical honesty".7 Meta has adapted to this by prioritizing content that feels organic and "lo-fi" in its algorithms, encouraging brands to move away from high-gloss production toward "behind-the-scenes" transparency.

Commercially, Instagram acts as a visual mall. It is the preferred platform for brand discovery, with 16.6% of global internet users aged 16-64 citing it as their favorite social platform.6 The integration of shopping features directly into the visual feed allows for a seamless transition from inspiration to transaction, a funnel that is particularly effective for fashion, beauty, and lifestyle brands.

2.3 WhatsApp: The Global Operating System

Often overlooked in US-centric analyses, WhatsApp is arguably Meta’s most powerful asset for global dominance. With 3 billion MAU 1, it is the primary communication operating system for Latin America, India, and large swathes of Europe and Africa.8 In these regions, WhatsApp is not merely a messaging app; it is the default infrastructure for business, government, and family life.

The 2026 strategy for WhatsApp centers on Business Messaging. By enabling businesses to conduct customer service and sales directly within encrypted chats, Meta is monetizing the high-trust, high-open-rate environment of private messaging. The platform’s dominance is so absolute in markets like Brazil and India that it faces virtually no competition, serving as the de facto internet for millions of users who rarely browse the open web.

2.4 Threads and the Fediverse Strategy

Threads, Meta’s text-based competitor to X (formerly Twitter), represents a strategic pivot toward "Open Gardens." Recognizing the user fatigue with walled ecosystems, Meta has begun integrating Threads with the Fediverse—a decentralized network of servers running on the ActivityPub protocol.9

This integration allows Threads users to view posts from and interact with users on other federated platforms like Mastodon, without leaving the Meta ecosystem.10 This "embrace and extend" strategy serves a dual purpose: it inoculates Meta against antitrust claims by theoretically opening its graph, and it positions Threads as the "user-friendly" on-ramp to the decentralized web. While Threads has not yet achieved full federation or account portability 9, its opt-in sharing features mark the first time a major tech giant has acknowledged the sovereignty of open protocols.

3. The Video Duopoly: The War for Attention

In 2026, the primary currency of the internet is the short-form video view. Attention spans have compressed, and the "scroll" has replaced the "search" as the dominant mode of information intake. This landscape is dominated by a fierce duopoly: TikTok and YouTube.

3.1 TikTok: The Cultural Incubation Engine

TikTok remains the undisputed pacemaker of global culture. With approximately 1.59 billion MAU 6, it commands the attention of the youth demographic, with 32% of users aged 13-17 identifying it as their primary platform.8 Its growth in 2026 is defined by its expansion into older demographics and its aggressive push into search and commerce.

The Algorithm as a Moat:

TikTok’s primary competitive advantage remains its "Interest Graph." Unlike Meta, which relies on who you know (the Social Graph), TikTok’s algorithm relies exclusively on what you like. It can calibrate a user’s psychographic profile within minutes of viewing time, serving hyper-personalized content that requires no manual curation or "following" of creators.11 This creates a "passive discovery" engine that is unmatched in its ability to surface viral trends from unknown creators.

However, the platform faces headwinds. Reports from Metricool in 2026 indicate a decline in organic reach, with views dropping by 17% and interactions by 32% as the platform saturates.12 This "content inflation"—where the supply of video outstrips viewer attention—has made it increasingly difficult for new creators to break through without paid amplification.

3.2 YouTube: The Sovereign of Depth and the Living Room

YouTube, with 2.53 billion MAU 6, has successfully defended its territory by positioning itself as the "home of depth." While TikTok captures fleeting attention, YouTube captures intent and retention.

The "Bridge" Strategy:

YouTube’s greatest weapon against TikTok is YouTube Shorts. By 2026, Shorts has matured from a feature clone into a strategic funnel. The platform incentivizes creators to use Shorts as advertisements for their long-form content. A user might discover a creator via a 15-second Short, but the algorithm then nudges them toward a 20-minute deep-dive video.11 This "bridge" capability allows YouTube to offer significantly higher Revenue Per Mille (RPM) to creators, as long-form content supports mid-roll ads that short-form cannot.13

The Connected TV (CTV) Factor:

A critical, often underreported advantage for YouTube is its dominance of the living room. Over 50% of YouTube watch time now occurs on TV screens rather than mobile devices.2 This positions YouTube as a direct competitor to Netflix and traditional cable, accessing "TV Ad Spend" budgets that mobile-first apps like TikTok cannot touch. This "living room moat" secures YouTube’s place as the default entertainment utility for households, not just individuals.

3.3 Comparative Monetization Dynamics

For the creative class, the choice between TikTok and YouTube in 2026 is a choice between "Virality" and "Stability."

YouTube offers a robust, predictable income stream via its Partner Program, channel memberships, and Super Chats.13 It is the preferred platform for career creators who treat content as a business.

TikTok offers explosive but volatile growth. Its "Creator Fund" payouts have historically been lower and less consistent. Consequently, TikTok has pivoted to commerce, encouraging creators to rely on TikTok Shop affiliate commissions (discussed in Section 7) rather than ad revenue shares.15

4. The Knowledge Economy: The Shift to Social Search

One of the most profound structural shifts in the 2026 digital landscape is the displacement of traditional search engines by social platforms. For the demographics of Gen Z and Gen Alpha, "Googling" has been replaced by searching on TikTok, YouTube, and Instagram. These platforms have evolved into "Knowledge Engines," prioritizing human experience and visual verification over indexed web pages.

The behavior of information retrieval has fundamentally changed. Younger users perceive traditional search results—often cluttered with SEO-optimized blog spam and generic AI text—as untrustworthy. In contrast, a TikTok video of a real person demonstrating a product or a Reddit thread of a real community debating a topic carries a higher "authenticity weight".17

Data from WARC and TikTok reveals that queries related to fashion, beauty, and DIY are now 26% more likely to start on a social video platform than on a traditional search engine among younger cohorts.18 In response, brands have had to pivot their strategies from traditional SEO to S-SEO (Social Search Optimization). This involves optimizing video captions, using hashtags as keywords, and structuring video content to answer specific questions (e.g., "How to fix a leaky faucet") to rank in social search results.17

4.2 Reddit: The Backend of the Internet

Reddit has emerged as the unsung victor of the AI revolution. As the internet becomes flooded with AI-generated content, the value of Reddit’s 19 years of human-moderated conversation has skyrocketed. It has effectively become the "verification layer" for search.

The Citation Economy:

Reddit’s strategic licensing deals with Google and OpenAI (worth roughly $60M and $70M annually, respectively) have integrated its data directly into Large Language Models (LLMs).19 Consequently, Reddit is consistently the most cited domain in AI-generated answers on platforms like Google’s AI Overviews, Perplexity, and ChatGPT.20 This "citation economy" has driven a surge in referral traffic, with some reports indicating a near-tripling of readership between late 2023 and 2025.19

AI Translation and Global Expansion:

To further capitalize on this, Reddit has deployed AI-powered translation tools that automatically translate posts into the user’s native language (e.g., French, Spanish, Portuguese) in real-time.21 This removes the language barrier that previously confined Reddit to the Anglosphere, opening up its vast repository of human knowledge to a global audience and driving rapid user growth in markets like France.21

5. The Privacy Rebellion: Decentralization and Encryption

The centralization of digital life has triggered a powerful counter-movement. A growing segment of the population, fatigued by surveillance capitalism and algorithmic manipulation, is migrating toward platforms that offer privacy, encryption, and user control. This "flight to privacy" has transformed from a niche concern into a marketable competitive advantage.

5.1 Signal: The Standard for Private Communication

Signal has fundamentally altered the privacy landscape in 2026 by decoupling identity from telephony. The introduction of Usernames allows users to communicate without ever revealing their mobile phone numbers.24 This feature is a critical safety upgrade for activists, journalists, and anyone wishing to compartmentalize their digital interactions.

Competitive Advantage:

Signal’s moat is its "Zero-Knowledge" architecture. Unlike Telegram (which does not end-to-end encrypt chats by default) or WhatsApp (which encrypts content but collects extensive metadata), Signal stores virtually no data on its users. The removal of the phone number requirement eliminates the last major vector for "social graph mapping," making it the only mainstream platform that offers true digital solitude.26

5.2 Bluesky and the Fediverse: The Open Social Web

The volatility of X (formerly Twitter) has accelerated the adoption of the Fediverse—a network of interconnected servers running on open protocols like ActivityPub and the AT Protocol.

Bluesky: By early 2026, Bluesky has grown to over 40 million users, tripling its user base in a single year.27 Its primary innovation is "Algorithmic Choice." Unlike traditional platforms that force-feed a single optimization function (usually "engagement"), Bluesky allows users to subscribe to third-party algorithms. A user can choose a "Scientific Feed," a "Chronological Feed," or a "Positive Vibes Only" feed, effectively creating a marketplace for curation.28

X (Twitter) Decline: Data from 2026 shows that X’s daily usage advantage is shrinking, particularly among younger demographics. Among Gen Z, the gap between X and its decentralized competitors like Threads and Bluesky has narrowed to just 6-10 percentage points.29 The migration is driven by a desire for portable social graphs—users want to "own" their followers and take them to other platforms, a capability that open protocols promise.

5.3 Telegram: The Crypto Super App

Telegram has crossed the 1 billion MAU threshold 30 and has evolved into a distinct "Super App" ecosystem.

Toncoin Integration: The deep integration of the TON (The Open Network) blockchain allows for seamless crypto payments within chats. Users can pay for subscriptions, buy digital goods, and transfer funds globally without leaving the app.32

The "Mini-App" Economy: Telegram has successfully replicated the WeChat model for the West (and Global South). Developers can build "Mini-Apps"—lightweight web apps that run inside Telegram chats—allowing users to order food, play games, or manage crypto wallets. This app-within-an-app architecture bypasses the Apple/Google app store duopolies, creating a parallel digital economy.33

Premium Success: With over 15 million paying subscribers for Telegram Premium, the platform has proven that users are willing to pay for enhanced features (larger uploads, faster speeds, transcription), validating a business model that is not 100% dependent on ads.31

6. Specialized & Professional Networks

While the giants fight for mass attention, specialized networks have carved out lucrative fiefdoms by focusing on specific modes of interaction.

6.1 LinkedIn: The Professional Broadcaster

LinkedIn has approached the 1 billion member mark 30 and has seen a surge in engagement by pivoting to video.

Video First: LinkedIn posts with video now generate 5x the engagement of text-only posts.35 The platform has become the de facto "news feed" for the white-collar class, replacing trade publications.

B2B Influencers: A new class of creator has emerged—the "B2B Influencer." These are CEOs, consultants, and experts who monetize their presence via newsletters and premium courses. LinkedIn’s competitive advantage is the high value of its audience; an ad impression on LinkedIn, targeting a decision-maker with a budget, is worth significantly more than a generic impression on TikTok.2

6.2 Discord: The Operating System of Community

Discord has transcended its gaming roots to become the "third place" for internet communities. In 2026, it is less of a chat app and more of a "shared computer."

Embedded App SDK: The launch of the Embedded App SDK allows developers to build interactive experiences that run inside Discord voice channels.36 Friends can play poker, use a shared whiteboard, or watch videos together in a synchronized "Activity." This increases "dwell time" and transforms the platform into a collaborative OS.

Revenue Model: Generating over $575 million in revenue 38, Discord continues to rely on Nitro subscriptions rather than advertising. This "user-aligned" revenue model protects the user experience from the clutter of ads, making it a safe haven for communities that value privacy and intimacy over broadcast reach.

6.3 Snapchat: The AR Pioneer

Snapchat maintains a robust daily active user base of 432 million 39, primarily among teens and young adults. Its moat is Augmented Reality (AR).

AR Dominance: Over 350 million users engage with AR features daily.40 Snapchat’s "Lens Studio" and generative AI tools allow users to create complex AR experiences that merge the digital and physical worlds.

Social Graph Utility: Unlike TikTok, which is for entertainment, Snapchat is for "real friends." Its "Map" feature and ephemeral messaging make it the primary coordination tool for offline social lives in the US and Europe.

7. The AI Infrastructure: Technological Moats

In 2026, Generative AI is no longer a novelty feature; it is the fundamental infrastructure of social media. The platforms that provide the best AI tools to their creators are winning the content war by lowering the barriers to production.

7.1 Google Veo and YouTube Shorts

Google has integrated its state-of-the-art DeepMind Veo model directly into the YouTube Shorts creation flow.

"Ingredients to Video": This feature allows creators to upload a few static images or a rough prompt, which Veo then transforms into a high-quality, 60-second vertical video.41 It can generate consistent characters and backgrounds, effectively giving every creator a virtual film studio.

Vertical Native: Veo generates video in native 9:16 vertical format, eliminating the need for awkward cropping and ensuring high-fidelity output for mobile screens.42 This drastically reduces the cost of production, leading to a flood of high-quality, AI-assisted content that keeps viewers retained on the platform.

7.2 TikTok Symphony: The Commercial AI

TikTok’s "Symphony" suite focuses on the commercial side of the creator economy.

Ad Generation: Symphony can ingest a product URL and automatically generate a script, hire an AI avatar to act it out, and edit the final video ad.44 This allows small businesses to create "influencer-style" ads without ever hiring a real influencer.

Global Dubbing: The Symphony AI Dubbing tool automatically translates and dubs video content into multiple languages, preserving the original speaker's voice and lip movements.46 This breaks down the language silos that previously segmented TikTok, allowing a creator in Brazil to go viral in Japan instantly.

7.3 Meta’s AI Personalization

Meta has embedded AI generation into its ad manager to achieve "Hyper-Personalization at Scale."

Dynamic Creative: By 2026, Meta’s AI can generate millions of unique ad variations for a single campaign. It can dynamically change the background of an image, the text overlay, or even the music track to match the specific psychographic profile of the viewer.47 This level of customization was economically impossible with human designers but is now standard practice, driving higher conversion rates for advertisers.

8. Financialization: The Race for the Super App

The final frontier of 2026 is the integration of finance into social media. Platforms are racing to become "Super Apps"—destinations where users can not only chat and watch but also bank and shop.

8.1 X Money: The Fintech Gamble

X (formerly Twitter) is betting its future on X Money. In partnership with Visa, X is launching peer-to-peer payments and a digital wallet in 2026.48

The Vision: The goal is to replicate the success of WeChat Pay, allowing users to send money to friends, tip creators, and buy products without leaving the X app.49

The Challenge: While the technical infrastructure is being built, regulatory hurdles and trust issues remain. X is attempting to pivot from a "Town Square" to a "Marketplace," but it faces entrenched competition from dedicated payment apps like Venmo and Cash App, as well as the integrated payment systems of Apple and Google.

8.2 The Trillion-Dollar Commerce War

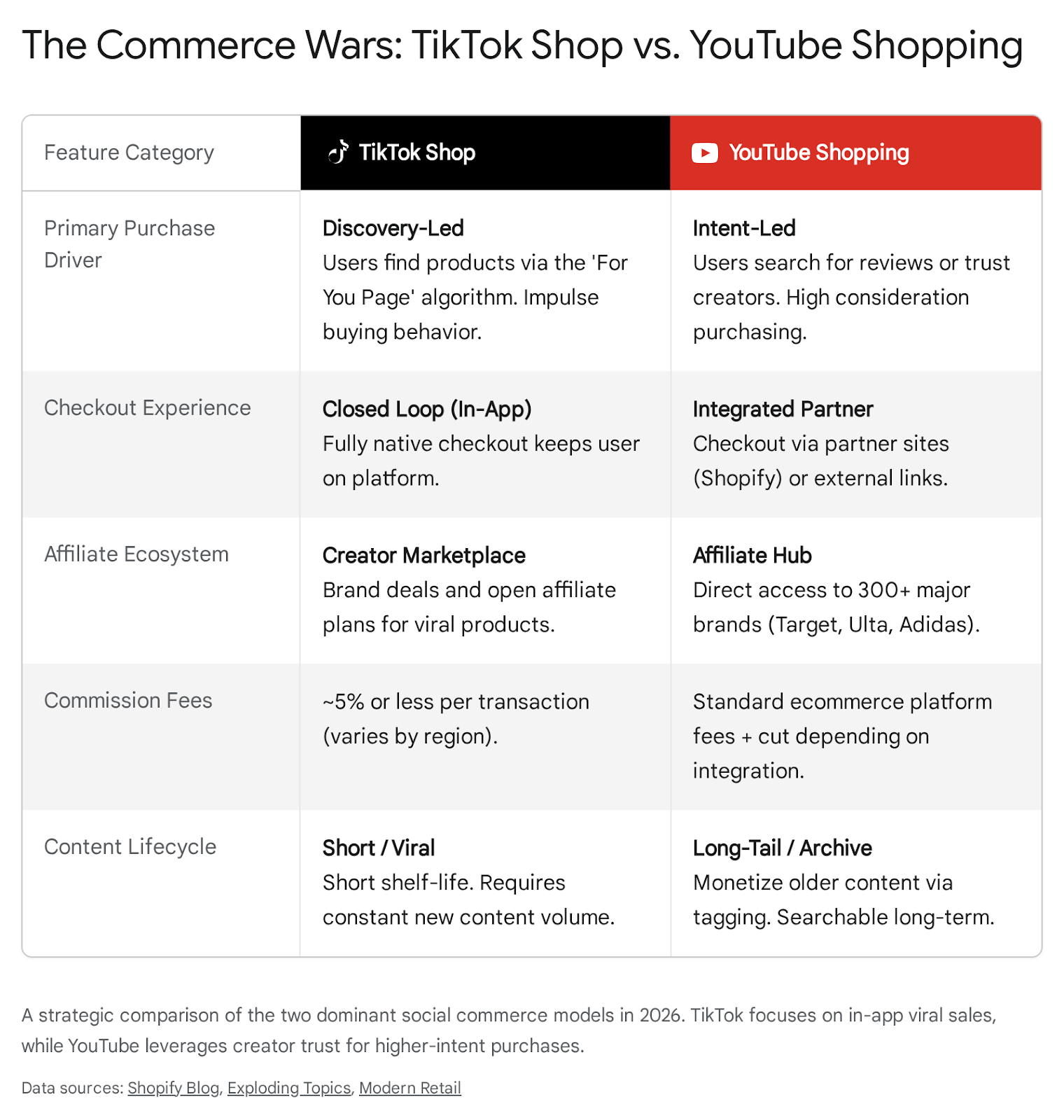

Social Commerce—the direct selling of goods through social apps—is expected to be a $1 trillion industry by 2028.50 The battle for this market is currently a duopoly between TikTok Shop and YouTube Shopping.

TikTok Shop (The Impulse Engine): TikTok has built a "Closed-Loop" system. It handles discovery, payment, and logistics. Its affiliate program is its secret weapon, offering commission rates of 5-30% to creators who tag products.51 This has created an army of salespeople who push products in every video, driving billions in "impulse" sales for low-ticket items like beauty products and gadgets.50

YouTube Shopping (The Trust Engine): YouTube focuses on "Intent." Its Affiliate Hub connects creators with major brands like Target and Adidas.52 YouTube excels at high-ticket items (electronics, home goods) where buyers need detailed reviews and trust the creator’s expertise. While TikTok wins on volume of transactions, YouTube likely wins on average order value (AOV) and long-term customer value.13

9. Conclusion: The Fragmented Future

As we look toward 2027, the social media market has irrevocably changed. The "Wild West" era of a single dominant platform is over. We have entered an age of fragmented specialization.

For Discovery: Users go to TikTok and YouTube.

For Identity & Utility: Users rely on Facebook and WhatsApp.

For Privacy: Users migrate to Signal and Bluesky.

For Knowledge: Users trust Reddit and LinkedIn.

The winners of 2026 are those who have successfully built a defensible moat—whether that moat is an uncanny algorithm (TikTok), a deep content library (YouTube), a massive social graph (Meta), or an unbreakable encryption protocol (Signal). For brands and creators, the strategy is no longer about "being on social media"; it is about managing a diversified portfolio of presence across these distinct, disconnected, and highly specialized digital nations.