I hear the same objection from nervous investors all the time: "William, everyone knows Coca-Cola is a great company. Isn't that already priced into the stock? How can I make money if everyone already knows?"

It is a valid question. But it is based on a flaw in human psychology known as Recency Bias.

As humans, we are terrible at predicting the long term. If a company has one bad quarter or faces a temporary scary headline, the market panics. Investors assume that a temporary problem will last forever. They sell, driving the price down.

This is where the calm investor strikes.

When you understand the concept of an Economic Moat, a durable competitive advantage that protects a company’s profits like a water-filled trench protects a castle, you stop worrying about next week's news and start focusing on the next decade's wealth.

Here is what you need to know about finding these rare gems.

1. True "Moats" Are Rare (and Not Graded on a Curve) 💎

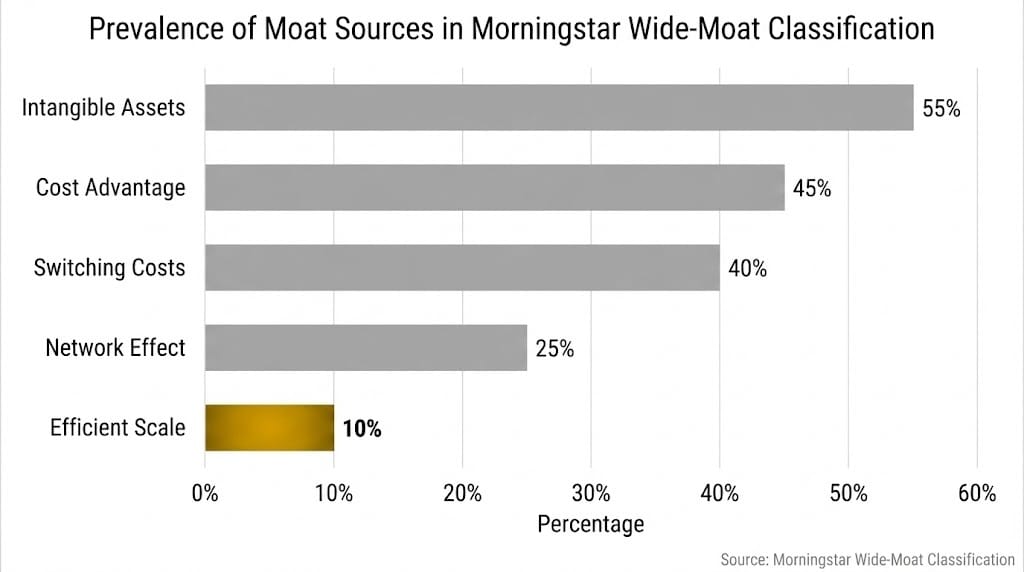

Most companies are average. In my analysis of the market, only about 10% of companies actually possess a wide economic moat.

We don't grade on a curve. Just because a company is the "best" in a struggling industry (like a slightly better airline or gold miner) doesn't mean it has a moat. We look for absolute strength. This is why you often see "boring" sectors, like payment processors or consumer staples, dominating the high-quality lists, while trendy sectors often fail to make the cut.

2. The Network Effect: The Most Explosive Moat 🚀

If you want high returns, look for the Network Effect. This happens when a product gets more valuable as more people use it.

Think of Visa or Mastercard. Every time a new merchant accepts the card, the card becomes more valuable to you. Every time you use the card, the network becomes more critical to the merchant. Historically, these companies generate the highest returns on invested capital. However, a word of caution: these stocks can be volatile. They react sharply to economic shifts, but their long-term engine is incredibly powerful.

3. High Switching Costs: The "Sticky" Moat 🕸️

Some companies are just too painful to leave.

Take Intuitive Surgical, the maker of robotic surgery systems. Once a hospital spends millions on the robot and trains their surgeons on that specific machine, are they going to switch to a competitor to save a few pennies? Absolutely not. The "switching costs" are too high.

We see this in software, too. Think of how hard it would be for a business to rip out all their Microsoft or Salesforce systems. These companies have customers who are effectively locked in for life.

4. Brands That Outlast Recessions 🛡️

Finally, there is the power of "Intangible Assets", mostly brands and patents.

Consumer giants like Coca-Cola or PepsiCo have some of the longest-lived moats in history. Why? Because their products don't go obsolete. Technology changes every year, but people will likely still be drinking soda and water 50 years from now. These companies offer stability when the rest of the tech world is panicking.

The Bottom Line

The market is myopic. It focuses on the next three months. By focusing on Moats, strong brands, network effects, and high switching costs, you are focusing on the next ten years. That is where the easy money is made.

Follow me for more simple, smart investing strategy.

Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨